One particular commenter raised problems which the Department's justification for selecting to established undergraduate loan payments at 5 p.c of discretionary cash flow is based upon investigating equivalent Added benefits for undergraduate versus graduate borrowers. They explained the Office by no means spelled out or justified why the Department's purpose need to be to maintain parity in Added benefits between The 2 populations, noting their distinctions in money and credit card debt.

The response to your prior comment summary discusses the overarching authorized authority for the ultimate rule. We also talk about the legality of distinct provisions for individual elements during this portion. Nonetheless, the Department highlights the unbiased nature of each of those factors. This regulation is composed of a number of distinctive and important improvements towards the REPAYE prepare that separately offer borrowers with critical Positive aspects. Below we determine those that obtained the greatest general public focus by means of remarks; but exactly the same could well be genuine for products that did not produce the very best level of public fascination, including the therapy of pre-consolidation payments, use of IBR in default, computerized enrollment, as well as other parameters. Increasing the level of cash flow protected against a hundred and fifty p.c to 225 percent with the FPL can help extra small-earnings borrowers get a $0 payment and reduced payment amounts for borrowers higher than that profits level that may even help middle-profits borrowers. All those techniques might help lower fees of default and delinquency and help make loans far more workable for borrowers. Lowering to five p.c the share of discretionary cash flow set toward payments on undergraduate loans will even focus on reductions for borrowers that has a non-zero-dollar payment. As mentioned inside the IDR NPRM and yet again in this ultimate rule, undergraduate borrowers depict the mind-boggling majority of borrowers in default.

Many commenters instructed the Section reassess the income safety threshold per year or at other frequent intervals. A person of such commenters commended the Section for proposing these regulatory adjustments and questioned that we periodically reassess if the 225 per cent threshold protects ample money for fundamental dwelling charges and also other inflation-associated expenditures which include elder care. Discussion:

Other commenters prompt which the time used in selected deferment and forbearance durations that count toward PSLF even be counted towards IDR forgiveness. Discussion:

We concur, partially, Along with the commenter in regards to the difficulties borrowers encounter for the duration of recertification. As we acknowledged in the IDR NPRM, The existing software and recertification processes build sizeable worries with the Department and borrowers. As an answer, we feel that the authorities granted to us underneath the long run Work as codified in HEA segment 455(e)(eight) allows us to acquire a borrower's AGI for long term decades if they provide acceptance for your disclosure of tax information and facts.

HEA section 455(d)(one)(D) necessitates the Secretary to provide borrowers an ICR strategy that may differ yearly repayment amounts dependent on the borrower's money and that is paid about an extended stretch of time, never to exceed twenty five years. For the bottom stability borrowers, we feel that ten years of monthly payments signifies an extended length of time. Borrowers with minimal balances are most commonly individuals that enrolled in postsecondary schooling for one educational yr or less.

Several commenters disagreed Together with the proposed regulations concerning defaulted borrowers. They believed that the cohort default costs (CDR) and repayment charges on Federal loans ended up critical indicators of regardless of whether a selected establishment is adequately preparing its graduates for success in The task industry so that they're in the position to gain sufficient income to stay present on their own pupil loan repayments. Another commenter thought that although our proposals may perhaps mitigate the chance of default for specific borrowers, our proposals would also reduce the utility of CDR fees. This commenter reasoned that if CDR had been to become a ineffective accountability tool, we would wish new methods of high quality assurance for establishments.

We've clarified that only borrowers who're repaying a loan within the PAYE or ICR approach as of July one, 2024, may possibly continue to work with those ideas Which if this kind of borrower switches from Those people programs they would not have the capacity to return to them. We retain the exception for borrowers having a Direct Consolidation Loan that repaid a Dad or mum Moreover loan.

We disagree Along with the commenters' methodological critiques. Our rationale for arriving at the discretionary profits percentages was depending on our statistical analysis of the dissimilarities in costs of fabric hardship by distance for the Federal poverty threshold utilizing information from the SIPP. We Take note that our figures ended up revealed within the IDR NPRM in addition to our plan rationale for arriving at 225 88 cash loan p.c on the FPL. As we said inside the Evaluation, an indicator for whether a person expert materials hardship was regressed on a constant term in addition to a series of indicators equivalent to mutually unique categories of family members revenue relative towards the poverty level. The Assessment sample incorporates men and women aged eighteen to sixty five who had remarkable schooling debt, experienced Earlier enrolled in a very postsecondary institution, and who were not at the moment enrolled. The SIPP can be a nationally representative sample and we claimed regular errors applying replicate weights from your Census Bureau that can take into consideration sample dimensions. The Division utilised these information Get started Printed Website page 43842 as they are commonly utilised and nicely-proven as the top resource to comprehend the economic perfectly-remaining of people and households. The desk notes clearly show that two stars reveal approximated coefficients which happen to be statistically distinguishable from zero on the 1 p.c amount.

This arrives out to become an $800 variation which can be a cause of men and women offering a vehicle in these states to look at a private sale.

Congress has granted the Department obvious authority to generate earnings-contingent repayment options beneath the HEA. Precisely, Sec. 455(e)(4) [19] of your HEA supplies the Secretary shall problem laws to establish profits-contingent repayment schedules that demand payments that vary in relation to the borrowers' yearly income. The statute more states that loans on an ICR approach shall be “paid over an extended timeframe prescribed by the Secretary,” and that “[t]he Secretary shall create procedures for figuring out the borrower's repayment obligation on that loan for these kinds of calendar year, and these other procedures as are required to correctly apply profits contingent repayment.” These provisions intentionally grant discretion to your Secretary around the best way to assemble the particular parameters of ICR options. This features discretion as to just how long a borrower have to pay back (except that it are not able to exceed 25 several years).

Though most car buys are created with automobile loans within the U.S., there are Gains to purchasing an automobile outright with cash.

You should not assume too much benefit when buying and selling in aged autos to dealerships. Promoting aged vehicles privately and utilizing the funds for just a foreseeable future car order tends to end in a more monetarily appealing result.

The Division thinks the remark interval offered enough time for the general public to post feed-back. As pointed out above, we received more than 13,600 composed remarks and viewed as Each individual one which dealt with the issues inside the IDR NPRM. In addition, the negotiated rulemaking system delivered significantly more possibility for community engagement and opinions than observe-and-comment rulemaking without having several negotiation periods. The Office commenced the rulemaking course of action by inviting general public input through a number of community hearings in June 2021. We been given much more than five,300 public feedback as A part of the public hearing process. After the hearings, the Office sought non-Federal negotiators with the negotiated rulemaking committee who represented constituencies that may be afflicted by our procedures.[four] As aspect of such non-Federal negotiators' work on the rulemaking committee, the Division questioned which they arrive at out into the broader constituencies for responses over the negotiation course of action. For the duration of Every single on the 3 negotiated rulemaking sessions, we supplied opportunities for the public to remark, which include immediately after observing draft regulatory text, which was accessible ahead of the 2nd and third classes.

Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Nancy McKeon Then & Now!

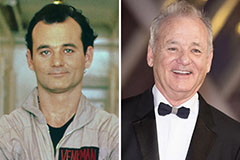

Nancy McKeon Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!